BLUF

Diesel prices in Nigeria have almost quadrupled since 2021 due to increased price volatility in global oil markets and the devaluation of the Naira, the local currency. Eighty percent of on-grid energy consumers rely on diesel generators for backup power supply; however, the recent price hikes have led to solar power becoming the cheapest backup electricity source for most consumers. However, high upfront costs limit the adoption of solar, so companies need to develop business models that reduce the acquisition cost of solar technologies relative to generators.

Background

The COVID-19 pandemic and, more recently, the Russia-Ukraine conflict have disrupted global energy demand, supply, and international trade patterns and increased price volatility in oil markets.1 Crude prices are forecast to remain higher at $90-125/barrel through 2023.2 Nigeria has historically subsidized energy costs to reduce the impact of high commodity prices on consumers. The price hikes and the devaluation of the Naira have ballooned the cost of fuel subsidies to the state.3 The International Monetary Fund (IMF) predicted that Nigeria’s fuel subsidy bill could rise to 6 trillion Naira ($14.4 billion) in 2022, more than four times what was spent in 2021.4,5,6 While the subsidy has limited the rise in petrol prices, diesel prices – which were deregulated in 2013 – have almost quadrupled since 2021.7

Due to the persistent unreliability of electricity supply from the national grid, there is widespread dependence on diesel generators for backup supply, especially among residential and commercial consumers with higher consumption levels.8 The Energy Commission of Nigeria estimated that Nigerians spend $22 billion on diesel generators and fuel annually.9 Efforts to improve service delivery from the grid, including by introducing higher service-reflective tariffs in 2020, have failed to improve supply, leading to the continued reliance on diesel.10 Price pressures are now pushing consumers to consider alternatives to their generators, and solar power is emerging as a frontrunner.

How solar compares to alternative sources of electricity

Table 1 shows the typical electricity usage by different consumer groups in Nigeria. Income levels and business types typically determine the level of grid supply received, the capacity of generators required, and how long the generators are run.

TABLE 1: Typical electricity usage by different consumer classes in Nigeria17,18,19

| Consumer | Examples of customers in the consumer group | Grid supply needed (hours) | Grid supply received (hours) | Genset capacity (KVA) |

|---|---|---|---|---|

| Off-grid | Rural communities | N/A | 0 | <5 |

| Low-consumption, low-reliability | Low-income residential; Small C&I (barbershops, kiosks, tailors) | <8 | 2 | <10 |

| Medium-consumption, medium-reliability | Middle-to-high-income residential; Medium-scale C&I (offices, banks) | 8-16 | 6 | 10-75 |

| High-consumption, high-reliability | Large residential (housing estates, serviced apartments); Large C&I (manufacturing, hospitality) | 16-24 | 10 | >75 |

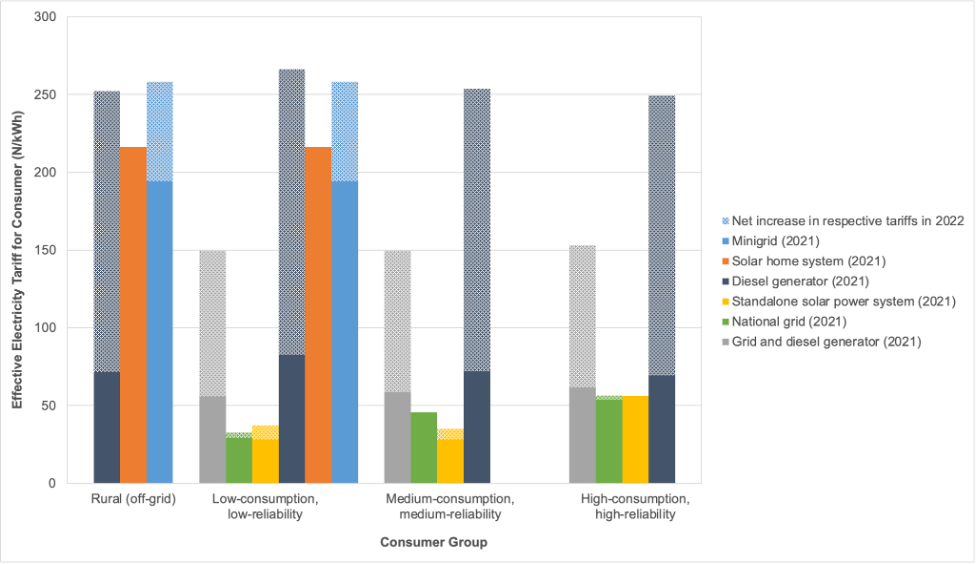

Figure 1 illustrates how the cost of electricity has changed between 2021 and 2022 for the consumer groups described above. Most notably, for consumers that rely on a blend of the national grid and diesel generators to meet their needs, electricity costs have increased by 150-170%. Those dependent on diesel generators alone have experienced a cost increase of 220-260%. The solar industry has also suffered from inflationary pressures and diesel price hikes as some systems (particularly mini-grids) are designed to operate with supplemental backup supply from generators, especially those sited in southern Nigeria, where there is greater cloud cover.20 Furthermore, the devaluation of the Naira also impacted the importation of solar equipment because importers typically get paid for goods and products in-country in Naira, leading to a rise in the price of equipment. As a result, solar product retailers and mini-grid developers have raised their product prices and tariffs by 25-33%, which is significant but modest compared to the alternatives. On the other hand, changes in the prices of solar home systems (less than 500W closed system generation units) and standalone solar systems for high-reliability consumers that are provided through lease-to-own, and energy-as-a-service business models (long-term PPAs), respectively, have not been observed due to their fixed monthly payments or tariff rates.

FIGURE 1: Electricity tariffs (in Naira per kWh) in 2021 and 2022 for different power sources across consumer groups in Nigeria.21,22,23,24

We find that the increase in diesel prices has most significantly changed the prospects of solar in rural areas. Given the high capital costs of setting up a solar mini-grid and limited availability of long-term finance to developers, the tariffs charged in 2021 were 2.7 times higher than the cost of running a diesel generator alone.25 While inflationary pressures such as devaluation affect all technologies, the high diesel price hikes have caused mini-grids and diesel generators to achieve cost parity. Similarly, solar home systems (SHS) that were 3 times as costly as diesel generators over their lifetime are now cheaper. For on-grid consumers, the cost of standalone solar systems was already lower than other alternatives except for the national grid in 2021. Higher diesel prices have only served to further entrench solar as the cheapest option, at less than a third of the cost of combined grid and generator use.

However, solar adoption has lagged in its potential as Nigeria’s cumulative installed solar capacity stood at 33 MW in 2021 compared to an estimated 13GW of diesel generation.26 Although a failure to implement pro-solar policies (e.g., tax and duty exemptions for components, and improved access to consumer credit) has contributed to this slow adoption rate, the higher acquisition costs of solar power systems are the primary barrier to adoption.

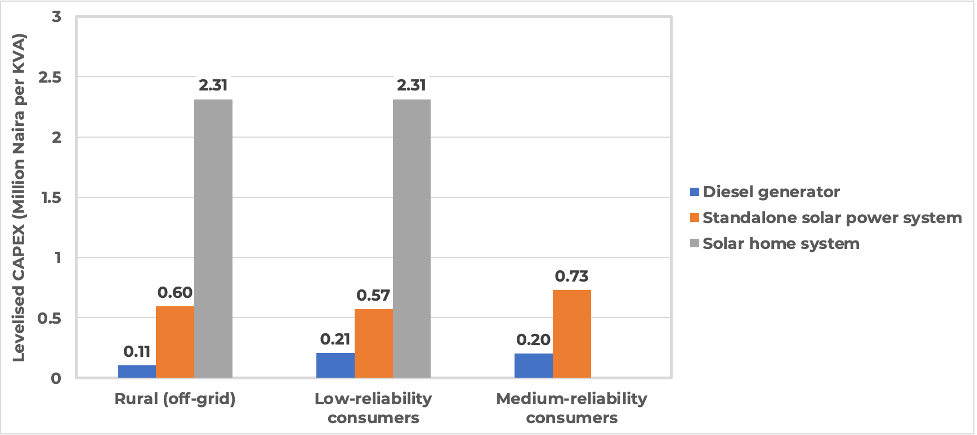

Figure 2 illustrates the levelized acquisition costs of different power technologies and shows that the cheapest solar alternative to diesel generators is often 3-5 times the cost of the generator. Thus, consumers with limited purchasing power and poor access to credit often have no choice but to purchase generators.27

FIGURE 2: Levelised capital costs of different electricity sources across consumer groups.28

What is the path forward?

Despite the better economics of solar electricity for consumers, a widespread public perception that generators are the most convenient and cost-efficient alternative to supplement grid supply still persists. Additionally, there is a lack of understanding about the solar solutions available on the market and the cost savings they offer.29 With increasing discontent surrounding the cost of living, it will benefit the Nigerian government to provide a policy and regulatory environment that makes it easier for consumers to access affordable solar solutions. Additionally, solar developers can change their product offerings to accommodate the purchasing power of the population. Recommendations for achieving this include:

Nigerian government

- Reinstate past import duty and Value Added Tax (VAT) exemptions for solar components. In 2018, the Nigerian Customs Service changed the classification of solar panels and made them subject to 10% import duty and VAT. Reversing this change and granting exemptions to other solar components (batteries, inverterters, etc.) could reduce the system’s costs for the consumer by up to 25%.30

- Deliver on the Solar Connection Intervention Facility. The Central Bank of Nigeria pledged 140 billion Naira in low-interest loans to solar system assemblers and retailers through local financiers, but this is yet to be realized. Currently, banks prefer to lend to large commercial entities in established industries such as oil and gas. Local solar developers are mostly startups and thus find it difficult to access local currency financing. This leaves their expansion dependent on access to concessional loans or grants from international investors and donors, and vulnerable to a depreciating Naira. The Central Bank should prioritize solar as a key industry for support going forward.

- Provide innovation funding and tax incentives. The government should implement fiscal policies in support of solar companies to help scale the sector, make it less import-dependent, and be an avenue for job creation.

Solar solution providers

- Offer more pay-as-you-go business models: Small solar home system (SHS) retailers have had the most success in the Nigerian market because of the pay-as-you-go (PAYG) models they offer. Nigeria has a combined unemployment and underemployment rate of over 50% and is experiencing rising inflation, so the purchasing power of individuals is dwindling. Therefore, retailers of larger solar systems need to offer more solutions that can be paid for over time to ease the initial cost burden of acquiring the technology and encourage consumers such as the 24-month lease-to-own plans offered by Arnergy. While the total cost of ownership could end up rising significantly, there is still demand for these models to ease the burden of upfront costs and energy payments.

Endnotes

- World Bank Group, “Commodity Markets Outlook: The Impact of the War in Ukraine on Commodity Markets,” World Bank, Washington, DC, 2022.

- N. McCulloch, T. Moerenhout and J. Yang, “Fuel subsidy reform and the social contract in Nigeria: A micro-economic analysis,” Energy Policy, vol. 156, no. 112336, September 2021.

- Fitch Solutions Country Risk & Industry Research, “Nigerian Naira Will Remain Stable In 2022,” 11 May 2022. [Online]. Available: https://www.fitchsolutions.com/country-risk/nigerian-naira-will-remain-stable-2022-11-05-2022

- Currency conversion done using the official exchange rate of N415.77/$ set by the Central Bank of Nigeria (CBN). This is the average monthly rate for June 2022, as quoted on the CBN’s website. The black market exchange rate of N607/$ would mean Nigeria’s budgeted fuel subsidy is $7.6 billion.

- World Bank Group, “Nigeria Development Update: Time for Business Unusual,” World Bank Group, Washington, DC, 2021.

- Editorial Board, “IMF and N6tr fuel subsidy warning,” The Guardian Nigeria, 27 June 2022. [Online]. Available: https://guardian.ng/opinion/imf-and-n6tr-fuel-subsidy-warning/

- National Bureau of Statistics, “Automotive Gas Oil (Diesel) Price Watch (May 2022),” June 2022. [Online]. Available: https://nigerianstat.gov.ng/elibrary/read/1241186

- Small generators (less than 5 KVA capacity) are often petrol-powered and are typically used by low-income households and small commercial entities.

- J. Inokotong, “Nigeria Spends ₦5.075trn Annually to Power Generators, Says AfDB,” Nigeria Electricity Hub, 5 December 2019. [Online]. Available: https://www.nigeriaelectricityhub.com/2019/12/05/nigeria-spends-₦5-075trn-annually-to-power-generators-says-afdb/

- C. Nweke-Eze, “What will cost- and service-reflective tariffs mean for the Nigerian electricity sector?,” 11 May 2021. [Online]. Available: https://www.energyforgrowth.org/memo/what-will-cost-and-service-reflective-tariffs-mean-for-the-nigerian-electricity-sector/

- These include off-grid solar generation systems and appliances for lighting (portable lanterns, multi-light systems) or other purposes (TVs, refrigeration units, fans, water pumps, radios, hair clippers, agro-processing machines, etc.).

- Naijalink Limited, “Sector Study: Solar Renewable Energy in Nigeria,” Netherlands Enterprise Agency, 2021.

- These include pico-solar solutions which are appliances (lamps, phones, etc.) that have small solar panels attached, and small standalone solar home systems (SHS) that include a few large solar panels to power energy-efficient lighting and appliances.

- These systems vary based on the customer’s needs and range from hybrid solar-battery-diesel systems that are entirely self-sufficient to backup systems designed to complement grid supply.

- A. Yakubu, J. Sherwood, E. Ayandele, O. A. Olu and S. Graber, “Minigrid Investment Report: Scaling the Nigerian Market,” The Nigeria Economic Summit Group (NESG), Abuja, 2018.

- C. Izuora, O. Bello and A. John, “Surging Diesel Price Puts Pressure On Businesses …SMEs say lack of cash hinders switch to alternative energy,” Leadership Nigeria, 14 June 2022. [Online]. Available: https://leadership.ng/surging-diesel-price-puts-pressure-on-businesses/

- Consumer classes are grouped by the minimum amount of reliable electricity service typically used per day.

- Note that the grid supply needed does not refer to the unconstrained demand of the consumer, but how much electricity they typically use from the grid which is a function of income levels (for residential consumers) and business type (for commercial consumers).

- Grid supply to customers and generator capacities used obtained from the National Bureau of Statistics surveys and market reports, BloombergNEF, “Solar for Businesses in Africa,” 24 January 2019. [Online]. Available: https://data.bloomberglp.com/professional/sites/24/BNEF_responsAbility-report-Solar-for-Businesses-in-Sub-Saharan-Africa.pdf; National Bureau of Statistics, “LSMS Integrated Surveys on Agriculture Nigeria General Household SurveyPanel, Wave 4,” Abuja, 2019.; and Prescient & Strategic Intelligence, “Nigeria Diesel Genset Market Research Report: By Power Rating (15 kVA–75 kVA, 76 kVA–375 kVA, 376 kVA–750 kVA, 751 kVA–999 kVA, 1000 and Above), Application (Commercial, Industrial, Residential) – Industry Analysis and Growth Forecast to 2030,” December 2021. [Online]. Available: https://www.psmarketresearch.com/market-analysis/nigeria-diesel-genset-market. For customer groups that do not have grid supply levels reported, it is assumed that the grid meets half of their daily electricity needs.

- The tradeoff in mini-grid design in areas that have significant cloud cover is to either oversize your solar generation and battery storage capacity (which increases CAPEX), or to have more backup generation from diesel (which increases OPEX).

- Note the consumers in rural communities do not use sufficient amounts of energy that they require a standalone solar power system of greater than 1 kVA. Additionally, because of the high capitals costs of large solar power systems, high-reliability customers are usually served through Energy-as-a-Service (EAAS) business models where they do not purchase the system but instead sign a Power Purchase Agreement (PPA) with a developer who provides them electricity at a pre-agreed tariff over a period of time.

- Data on diesel prices obtained from National Bureau of Statistics Automotive Gas Oil Price Watch monthly reports.

- National grid tariffs obtained from the Multi-Year Tariff order (MYTO) service reflective tariffs approved by the Nigerian Electricity Regulatory Commission.

- Price of generators and solar power systems obtained from manufacturers, distributors, and online marketplaces (Wavetra, Imperium, Lumos, Mikano, Perkins, Firman). Solar home system costs include financing, however it is not common for larger standalone solar systems to offer financing options, so costs for these systems do not include financing.

- C. Izuora, O. Bello and A. John, “Surging Diesel Price Puts Pressure On Businesses …SMEs say lack of cash hinders switch to alternative energy,” Leadership Nigeria, 14 June 2022. [Online]. Available: https://leadership.ng/surging-diesel-price-puts-pressure-on-businesses/

- I. Kua, Y. Obayashi and E. dela Cruz, “Factbox: Global fuel subsidies ramped up to counter energy price spike,” 17 March 2022. [Online]. Available: https://www.reuters.com/business/energy/global-fuel-subsidies-ramped-up-counter-energy-price-spike-2022-03-17/

- C. Olayinka, K. Jeremiah, J. Akubo, A. Abuh, J. Chinueze and R. Agboluaje, “FG sets aside PIA, to pay N4.6tr on fuel subsidy,” The Guardian, 25 January 2022. [Online]. Available: https://guardian.ng/news/fg-sets-aside-pia-to-pay-n4-6tr-on-fuel-subsidy/

- Note that mini-grids and standalone solar systems for high-reliability consumers are not purchased outright by consumers but provide energy as a service at a pre-agreed tariff.

- Naijalink Limited, “Sector Study: Solar Renewable Energy in Nigeria,” Netherlands Enterprise Agency, 2021.

- Heinrich Böll Foundation. Ebii, Chibueze, “Solar Import Duty and Tariffs. To Exempt or Not?” 2019. [Online]. Available: https://ng.boell.org/en/2019/07/02/solar-import-duty-and-tariffs-exempt-or-not