The Issue: The Development Finance Corporation (DFC) was launched in January 2020 with a dual mandate: mobilize private capital in less-developed markets and support U.S. foreign policy. (Although not explicit, the agency is also expected to be financially self-sustaining and not lose taxpayer money.) The BUILD Act which created the DFC clearly prioritized its development mission via both its name and an unambiguous direction to give primacy to low-income (LICs) and lower-middle-income countries (LMICs).

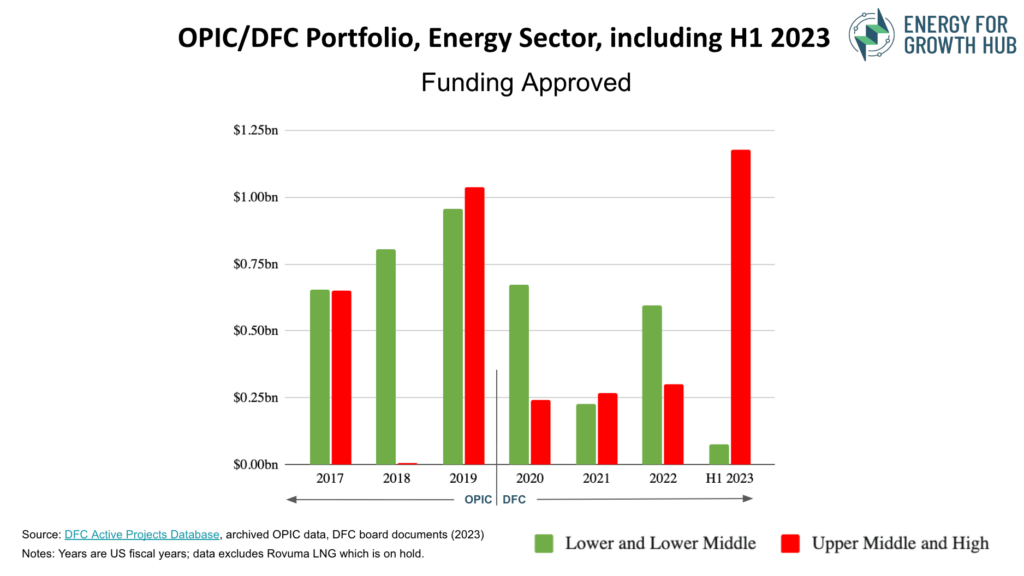

Source: Sect. 1412, BUILD ACT of 2018

Exceptions to the lower-income push:

- Waivers allow DFC investment in upper-middle-income countries (UMICs), provided projects support other interests or can show high development impact. This provision has been loosely interpreted.

- Congress passed the European Energy Security and Diversification Act in 2019, tasking the DFC to prioritize energy projects in Europe and Eurasia (regardless of income category) as a means to counter Russian influence.

As DFC approaches reauthorization in 2025, a core question: Is it meeting its original development mandate? Are the foreign policy exceptions becoming the rule?

Analysis of DFC’s portfolio1

The portfolio can be analyzed by project numbers or dollars approved. Project numbers are a good indicator of agency effort, while dollars approved are a good indicator of resource allocation. Considering both measures is important because LIC/LMIC economies are much smaller on average and thus projects in those markets are likely to be smaller too.

A few topline takeaways comparing the last three years of its predecessor agency the Overseas Private Investment Corporation (OPIC) versus the first three years of DFC:

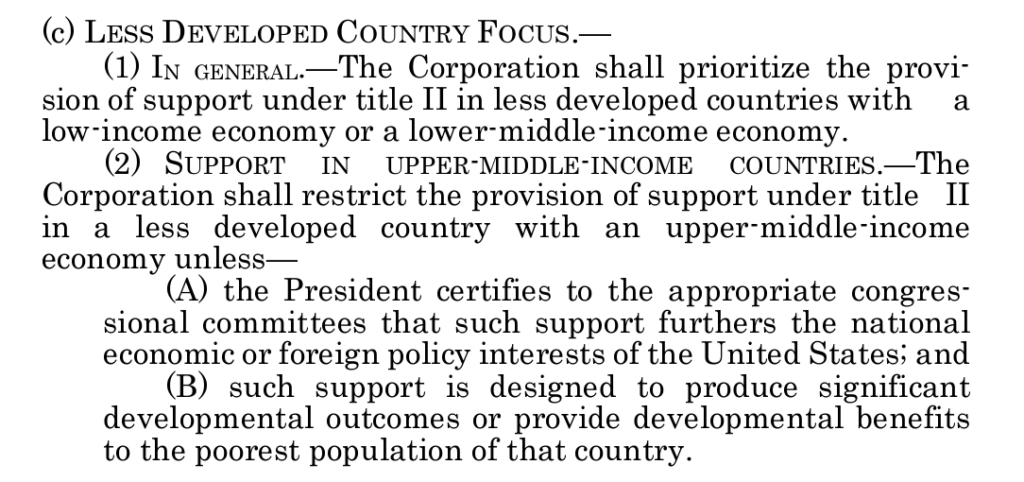

- Across all sectors, DFC is doing substantially more than OPIC, by both financial commitments and project numbers (Figure 1 and Table 1).

- The majority of projects are in poorer nations. Out of DFC’s 292 total projects in 2020-22, 194 were in LICs/LMICs.

- However, the majority of DFC investments are now flowing to richer countries. While the share of projects going to non-priority UMICs/HICs rose only from 31% to 34%, the share of financial commitments rose from 45% (2017-19) to 54% (2020-22).

FIGURE 1

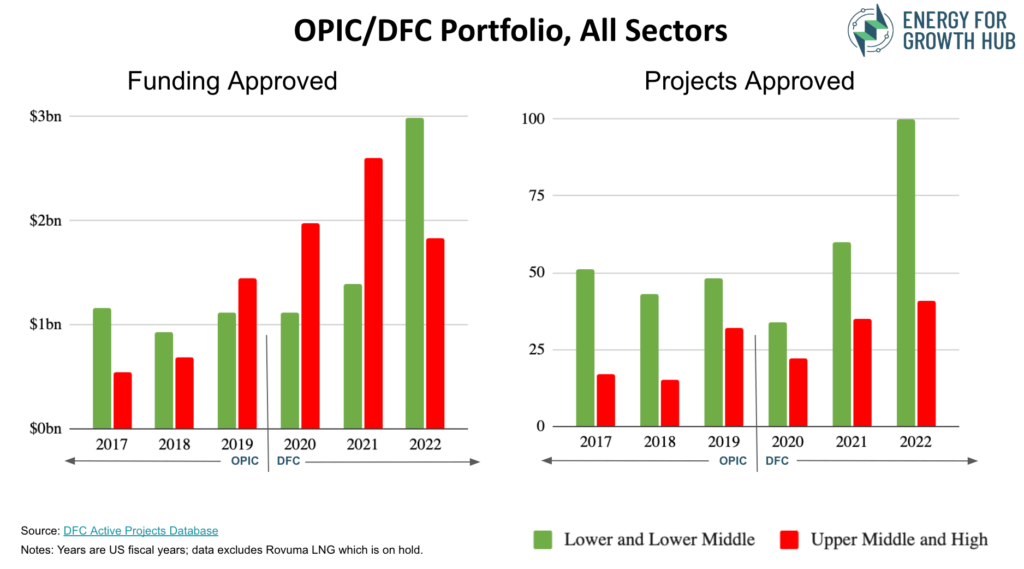

DFC’s energy portfolio. Energy is a core sector that historically has dominated OPIC’s portfolio and where expectations of DFC from Congress and the Administration are high. Energy investment was especially hard hit by pandemic disruptions, but we can conclude from the portfolio:

- DFC is doing (significantly) less than OPIC did in the energy sector. Both project numbers and financial volume dropped by more than 40% in 2020-22 versus the previous three years (Figure 2 and Table 1).

- As a result, energy is no longer the majority of the portfolio. Energy commitments have dropped from nearly 70% of the total portfolio to under 20%.

- The income balance is somewhat better in the energy sector. The share of energy projects in exceptional UMIC/HIC dropped by both project numbers (31% to 19%) and dollar volumes (41% to 35%).

FIGURE 2

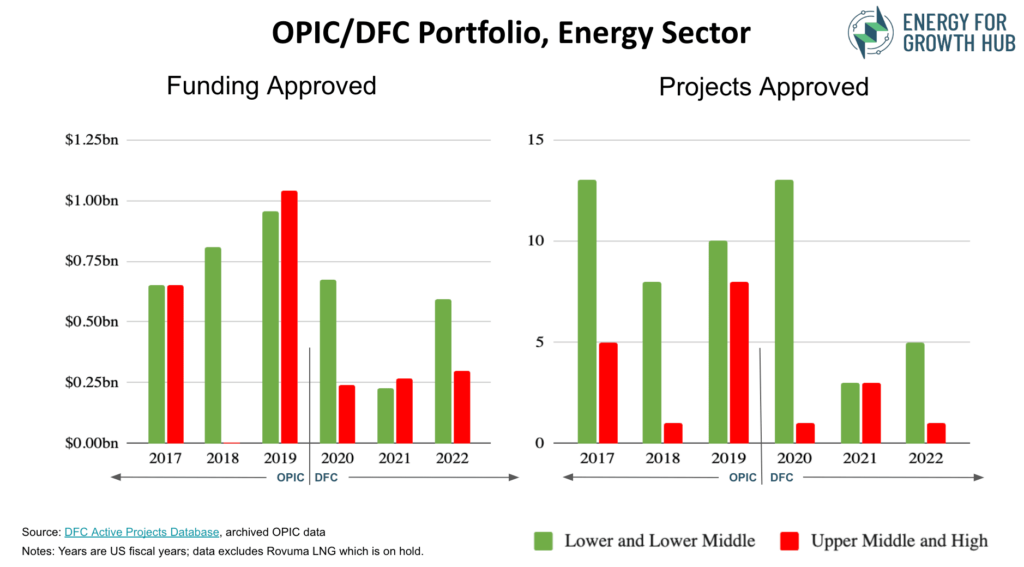

But recent approvals sharply skew the energy portfolio toward higher-income markets. While the DFC’s public database only covers up to 2022, board announcements add 9 new energy project approvals in the first half of 2023.

- Approvals include 3 relatively-large energy projects in comparatively-richer economies: $500m in Poland (HIC), $535m in South Africa (UMIC), and $144m in Ecuador (UMIC).

- Including H1 2023 in the DFC portfolio, the share of financial support for energy projects in higher-income markets climbs from 35% to 56% (Figure 3 and Table 1).

FIGURE 3

Bottom Line → Exceptions are becoming the rule. DFC is increasing its overall global investments but flows are trending toward wealthier countries outside its core development mandate. In the energy sector specifically, overall volumes are down while also investing a greater share in richer markets.

How Congress can help rebalance

The portfolio shift is not the fault of DFC staff nor the outcome of any one specific decision. Rather, the trend is a logical result of (a) conflicting pressures from Congress and the Administration to do more security- and climate-related projects and (b) limitations of DFC’s passive model, which relies on others to generate investment-ready projects. To mitigate these pressures, Congress should in the BUILD Act reauthorization:

- Reaffirm the primary development mandate of DFC and prioritize investments in capital-scarce markets.

- Create an aggressive early stage project development facility for LICs/LMICs to allow DFC to more actively build its own portfolio in these markets.

- Require a transparent portfolio reporting system that would clearly show aggregate projects by income group to create positive incentives for more (and larger) projects in riskier markets and highlight the accumulated effects of waivers on the overall portfolio.2

- Require transparent reporting of waivers with a publicly-disclosed explanation, including a public release of the ‘safe harbor’ list of sectors that qualify for flexible treatment.

- Establish a clear and specific high bar for HIC exceptions that would allow such projects only under exceedingly rare circumstances.

TABLE 1: OPIC/DFC Portfolio!function(){"use strict";window.addEventListener("message",(function(a){if(void 0!==a.data["datawrapper-height"]){var e=document.querySelectorAll("iframe");for(var t in a.data["datawrapper-height"])for(var r=0;r<e.length;r++)if(e[r].contentWindow===a.source){var i=a.data["datawrapper-height"][t]+"px";e[r].style.height=i}}}))}();

Endnotes

- All analysis below excludes the exceptionally large $1.5bn in political risk insurance for the Rovuma LNG project in Mozambique which was originally approved in Sept 2020 (FY19) but was put on hold and is unlikely to be renewed.

- e.g., Traffic Lights Could Help DFC Balance Its Portfolio and Mitigate Mission Creep, CGD, 2020.