July 2024 marked a notable milestone in the renewable hydrogen space in Africa and the world. A green ammonia production project in Egypt won the first renewable hydrogen offtake support in the world, worth €400 million from the German government. No renewable hydrogen market currently exists in Africa — or in the rest of the world. That’s why public financing mechanisms like this are among the few tools available to mitigate the risks faced by first movers.

African countries continue to be focal points for those envisioning large-scale low-cost renewable hydrogen supply. Our previous blog highlighted the challenges that ought to give market watchers pause about the scale of announced projects and the likely high cost of renewable hydrogen projects in Africa. The lion’s share of these proposed projects, most of which are in the concept phase, is expected to be bankrolled by non-African private project developers. However, given the large share of public financing in energy infrastructure investments on the continent and the role of public funds in emerging technologies, we took a closer look at public financing support. We found:

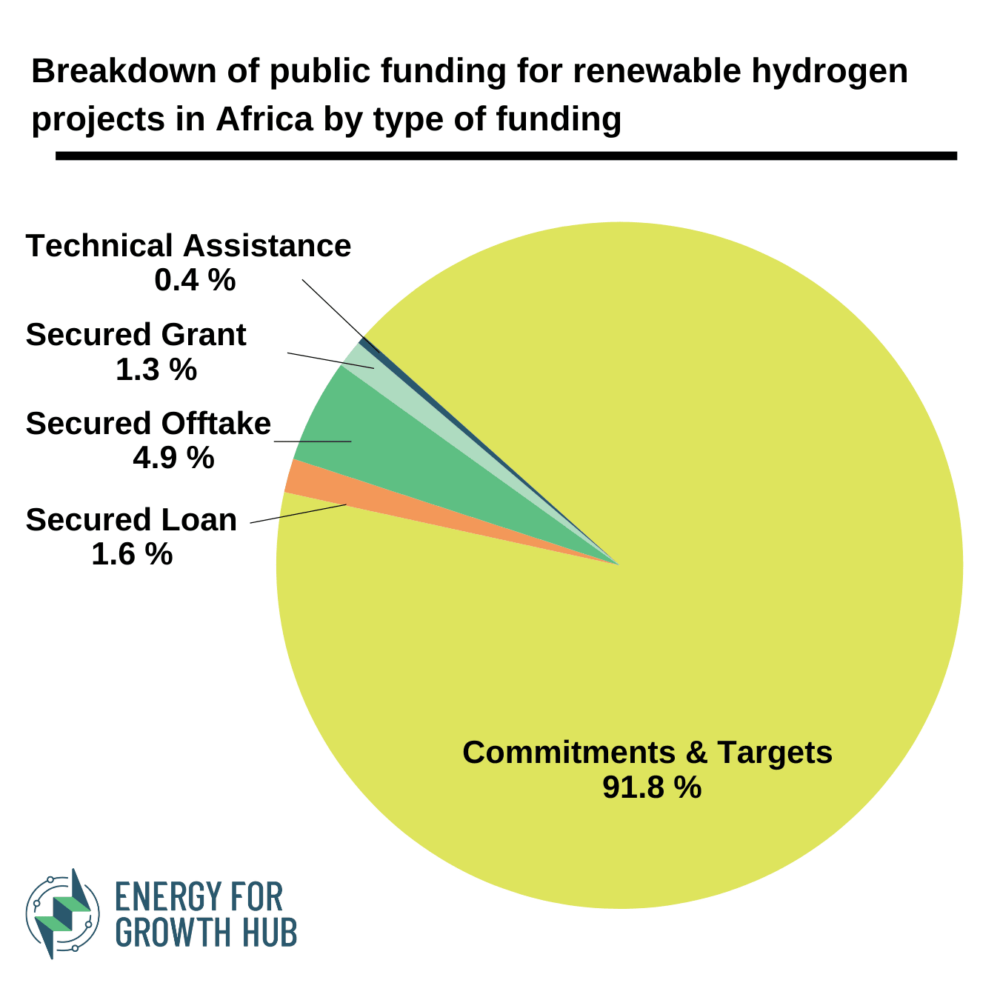

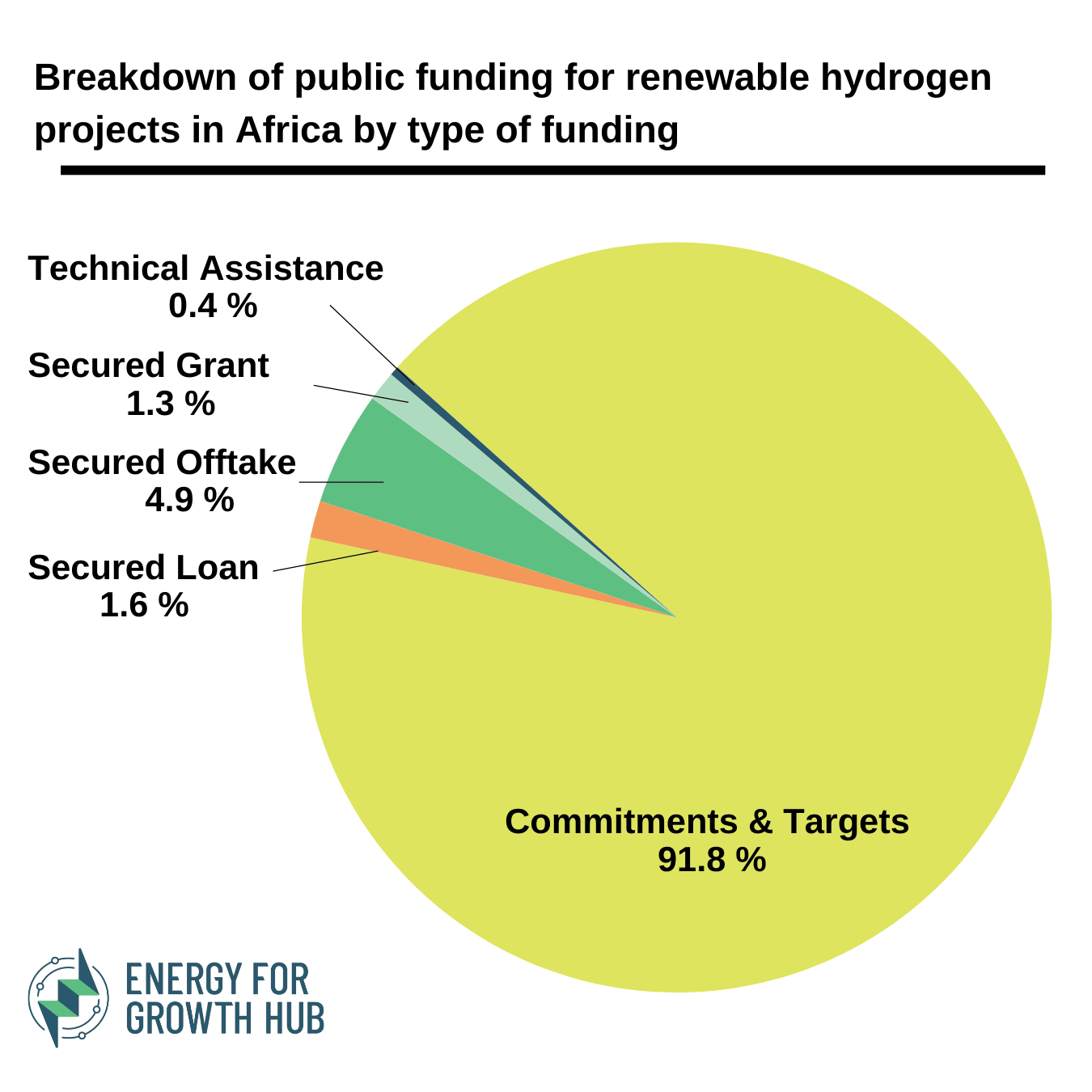

- Commitments abound, but funding falls short. Our review of publicly available data reveals over $8 billion in public funding (not including local funds) allocated directly or committed to renewable hydrogen or related activities in Africa. However, 92% of this funding consists of targets and commitments, lacking the details needed to justify the hype or address the significant investment required for meaningful deployment. If African countries were to grow current renewable hydrogen production from zero to 50 million tonnes a year by 2035, an ambitious estimate from the European Investment Bank, investment needs could reach over $130 billion, an amount comparable to all energy finance to Africa between 2017-2021.

- Germany leads in financing African renewable hydrogen projects. Nearly 80% of funding or funding commitments for renewable hydrogen projects in Africa come from European countries, with Germany providing 13% of the total through its development bank and demand-side mechanisms like H2Global. In contrast, the U.S. has shown minimal support for hydrogen projects on the continent, likely due to focus on the domestic market. Potential importers of African renewable hydrogen or derivatives like Japan have expressed interest, particularly in projects in South Africa, but have yet to commit financially. The World Bank, which launched the Hydrogen for Development Partnership in 2022 to help catalyze financing, is expected to support the Fertiglobe project in Egypt but has not yet allocated specific funds or financed any projects in the continent.

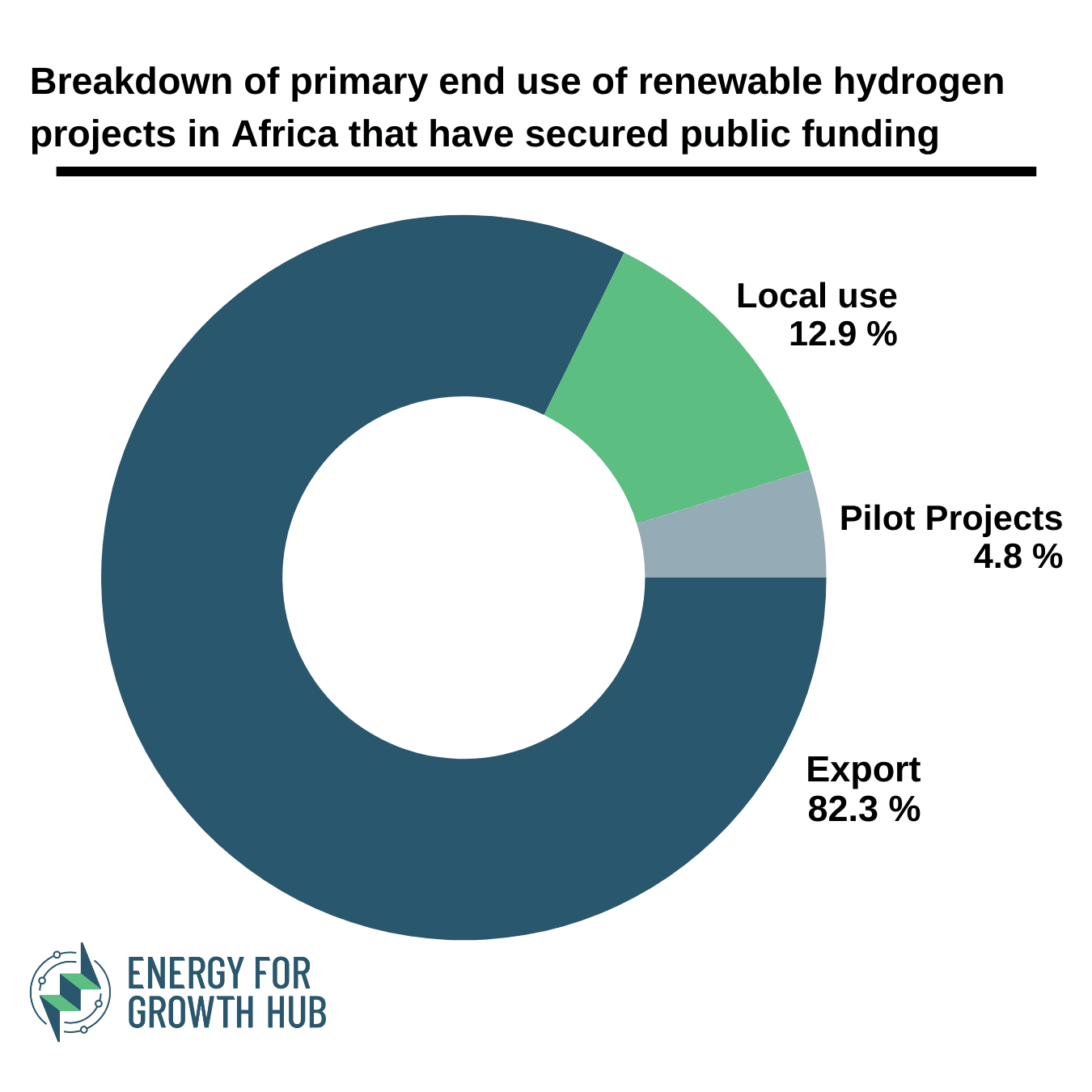

- Project-specific support is predominantly export-focused. Of the 15 projects that have secured a combined total of over $680 million in grants, loans, offtake and technical assistance, more than 80% of funding is allocated to export-oriented projects. This funding — $520 million of the total — is substantial for the 100-megawatt project in Egypt, but pales in comparison to the tens of billions governments and developers estimate will be needed for most projects. Furthermore, export-focused renewable hydrogen projects in Africa face competition, demand uncertainties, additional infrastructure costs, and geopolitical challenges.

- Namibia, Egypt, South Africa, and Mauritania have become central to Europe’s renewable hydrogen import ambitions. While projects have been proposed in 17 different countries, these four lead in securing direct funding or commitments from European countries. Despite Morocco’s proximity and the number of proposed projects, it has received comparatively low financial support — a surprise.

- Good news! African countries are not (yet) accumulating debt for renewable hydrogen projects. Less than 2% ($150 million) of public funding is in the form of loans, meaning that African nations have so far avoided substantial debt for renewable hydrogen projects. This is a positive, given that the market is still emerging, and the high-risk technology costs should not burden local citizens. However, while the funds may not be local, the value of land being offered to attract foreign investors should not be overlooked. For example, Morocco has offered 10,000 square kilometers, and Egypt has made 41,700 square kilometers available for hydrogen projects.

- Europe’s additional advantage in renewable hydrogen projects in Africa. Over 60 proposed projects across the continent feature significant involvement from European developers — including those from France, Germany, Denmark, Belgium, the UK, Norway, and the Netherlands. With a lead in hydrogen technology development and participation in multiple projects in Africa, European entities are well-positioned to benefit from public funding directed at these initiatives.

- If secured, the largest committed funds could support the entire value chain. The largest committed funding sources, such as the EU-Africa Green Energy Initiative and Germany’s PtX Development fund, are designed to finance a broad spectrum of activities. The former will finance projects that increase electricity production, energy access, and sustainable energy end uses. The latter will provide financial support for projects across the renewable hydrogen production value chain and infrastructure. Although these funds have yet to be fully allocated, the approach offers flexibility and a more integrated energy infrastructure.

Conclusion

A word on the funders: Given the nascency of the renewable hydrogen market and the specific challenges associated with advancing emerging technologies in emerging economies, there is a strong case to be made for not providing public finance at all. And yet, many western foreign financial institutions continue to push ambitious projections and funding commitments to match. They encourage African nations to invest in renewable hydrogen, promising substantial payoffs. But the reality is this: the renewable hydrogen market remains unformed, risky, and a heavy gamble for many emerging economies. If western financing institutions persist in beating the Africa-as-a-renewable-hydrogen-hub drum beat, they must commit to tangible, long-term and integrated investments that enable genuine growth pathways for the continent.

A word on the funding allocation: Public funding for renewable hydrogen projects in Africa is currently more about commitments than actual disbursement, often targeting countries and projects expected to supply to European countries. To effectively establish a renewable hydrogen market in Africa, funding should focus on supporting integrated energy infrastructure and foundational activities rather than attempting to rapidly scale up. Given the capital-intensive nature and the high costs associated with scaling emerging technologies like renewable hydrogen, public investments in early-stage developments like research, pilot projects, and demonstrations are crucial. This approach helps Africa build local capacity and reduce risks while also avoiding the pitfalls of premature large-scale deployment, which has historically led to unmet expectations of technological ‘leapfrogging.’ Furthermore, public funding for renewable hydrogen must align with the continents’ economic concerns and ambitions. Therefore, a mechanism that can bridge the cost gap and support local demand for renewable hydrogen in Africa is needed.