Next week, more than 32,000 people will descend on Baku, Azerbaijan for COP29, the annual Conference of the Parties to the United Nations Framework Convention on Climate Change. Global climate negotiations can seem (and often are) procedural and empty. But their implications for the future of energy and infrastructure in emerging and developing economies are increasingly real — especially when it comes to finance. In fact, watchers have dubbed the conference in Baku “the Finance COP.”

This year, the New Collective Quantified Goal (NCQG) on climate finance will top the agenda. But what is it, and why does it matter? Here’s a brief rundown of the NCQG and other key issues to watch, and some guiding thoughts on their implications for a high-energy low-carbon planet.

The New Collective Quantified Goal

The thorniest topic of debate for negotiators in Baku will be revisiting a key element of the Paris Agreement: the New Collective Quantified Goal (NCQG). Negotiators aim to agree on a new annual target for mobilized public climate finance from advanced economy governments to emerging and developing economies (EMDEs) post-2025. In 2009, the parties set the target, somewhat arbitrarily, at $100 billion per year by 2020, but didn’t meet it until 2022.

This time around, they will tackle four key areas of negotiation. Here’s a breakdown, along with my hopes for each:

- How much: The agreed dollar figure should start with a ‘T’, not a ‘B’. This time around, the new annual target will be based on estimated needs, rather than arbitrary politics. The key question is what share of the need it will actually cover. Estimates and methodologies vary, but it’s widely accepted that EMDEs (ex-China) need an additional $500 billion to $1 trillion in annual climate finance today. This figure will need to rise as high as $2.4 trillion by 2030 for the world to achieve the Paris Agreement goals. Recent party proposals have mostly hovered around $1-1.3 trillion per year, a 9-11x increase over 2022 levels. About a quarter to a third of this would be earmarked for adaptation.

- What kind: The new targets need to account for debt constraints and limited fiscal space, require more effective crowd-in of private sector investors, and allocate much more concessional capital. About 80% of the climate finance mobilized by the OECD from 2015-2020 was structured as debt. At least $18 billion of that was issued at market rates and at least $21 billion came with significant strings attached, ultimately causing capital to flow in the wrong direction. The looming sovereign debt crisis affecting at least 70 countries is a significant global hurdle that limits countries’ ability to invest in or attract investment in infrastructure, creating a cyclical trap that is hard to escape. The poorest and most climate-vulnerable countries spend more than twice as much on debt service as they receive in climate finance.

- Who pays: The precedent of responsibility is a major issue and will certainly be a sticking point. Since 2009, the donor base for the $100 billion target has been limited to OECD countries. Many developed countries now argue that higher-income non-OECD countries with higher emissions (including China, India, and Saudi Arabia) should join that donor base. And groups have put forward various approaches for estimating and apportioning responsibility. Part of this is a matter of including existing South-South financing in the total.

- What counts: Ensuring better accountability and transparency around what qualifies will be essential — regardless of the volume, asset, or source of the capital. Accounting for climate finance transparently has been a huge challenge. The lack of clarity has allowed a lot of double counting of contributions and dozens of irrelevant projects — including a chocolate shop, a hotel, an airport, and a romantic movie set — being misattributed as climate finance.

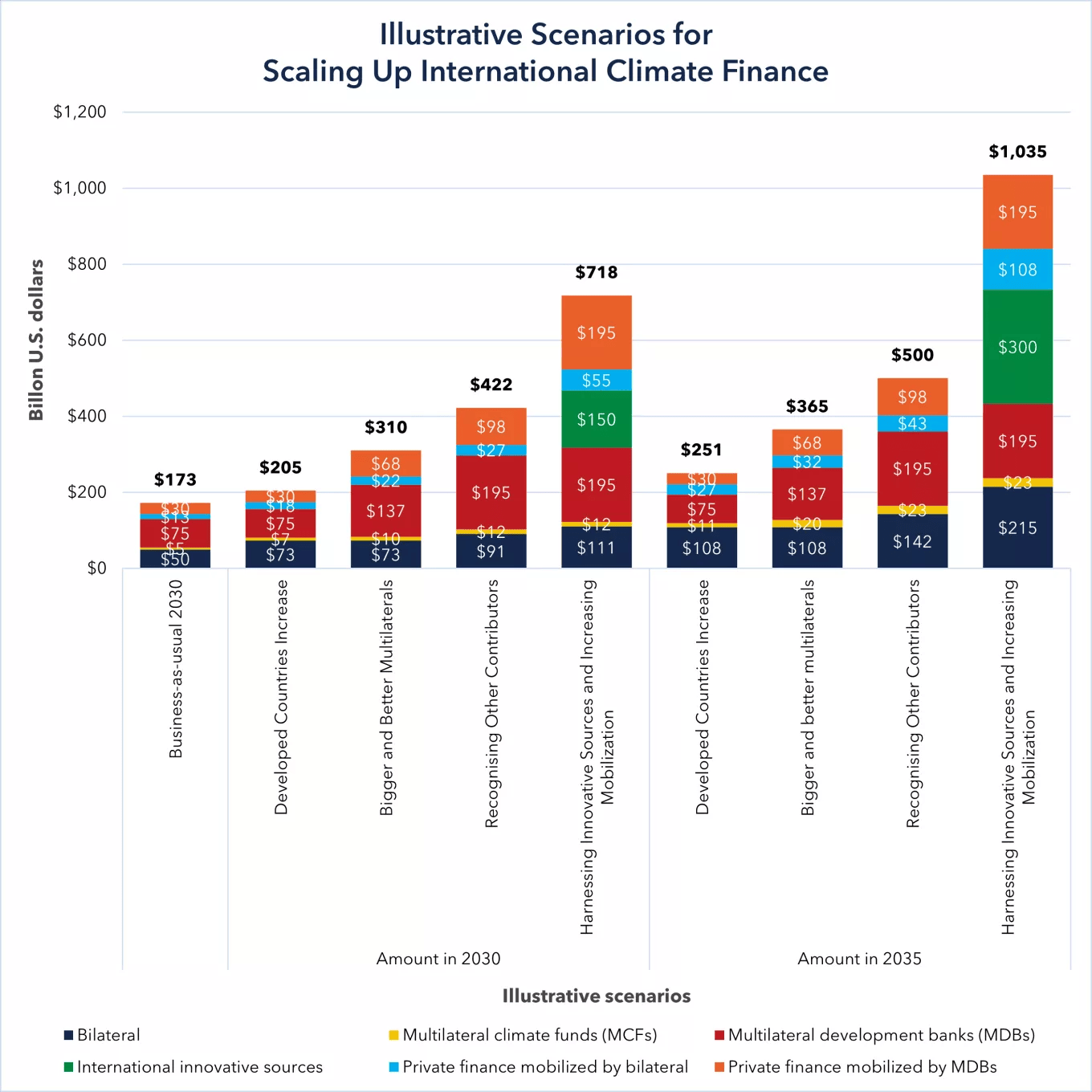

While it’s hard to predict where the dust will settle, donors have a few key levers to pull. These include increasing bilateral climate finance, as the US Development Finance Corporation has helped the US do recently; improving the efficiency of disbursement from multilateral climate funds and regional development banks; and better blending of public, private, and philanthropic capital structuring to increase mobilization.

FIGURE 1: Illustrative scenarios for scaling up international climate finance

Source: NRDC/Joe Thwaites

Why does the NCQG really matter?

Public climate finance cannot meet the large (and growing) need alone. Massive private capital mobilization will be necessary alongside stepped-up public investment, regardless of the agreed annual target. And getting that private money flowing depends heavily on public dollars. This means that a lower annual target for climate finance doesn’t just mean less public capital. It also means less private capital will be available to build the low-carbon energy infrastructure needed to power growth.

Other key finance issues at play

- Momentum behind Bridgetown 3.0 could put downward pressure on sovereign risk premia over time. The brainchild of Prime Minister Mia Mottley and Avinash Persaud of Barbados, the Bridgetown Agenda lays out a proposed set of reforms to the international financial system that would help fiscally constrained EMDEs escape the debt trap, recover from worsening climate disasters, and finance their energy transitions and climate resilience. Even as the scope has broadened, incremental progress towards this suite of proposals could result in material changes to the cost and availability of capital for energy projects in EMDEs.

- Commitments to the Loss and Damage Fund could surge. At COP28, the parties agreed to operationalize the “Fund for Responding to Loss and Damage,” which will help vulnerable countries recover from physical disasters caused by worsening climate change. So far, only $702 million has been committed, enough to cover merely 0.12% of the nearly $600 billion in economic losses EMDEs could face by 2030. The slower the pace of decarbonization, the worse climate damages will be in EMDEs, which bear the brunt of physical risks. This makes the Loss and Damage fund increasingly important and may unfortunately result in tradeoffs between quantums of finance allocated to mitigation, adaptation and resilience, and recovery from loss and damage.

- Wooly accounting details for international carbon markets could finally be worked out. Article 6 of the Paris Agreement lays out principles for voluntary cooperation among countries to reduce emissions through market and non-market mechanisms, namely carbon markets and regulations. Over 80% of Nationally Determined Contributions (NDCs) depend on the existence of functional, transparent, and trustworthy Article 6 mechanisms. Negotiations on the governance of voluntary carbon markets, the revenue allocation for adaptation and nature-based solutions, and high integrity verification standards for credits could have implications for the future mix of energy infrastructure projects EMDEs can close with international financing.

- Renewed NDCs may get more ambitious if the NCQG is high enough. The next round of NDCs are due early next year. As they stand today, 72% of EMDEs’ NDCs are fully or partially conditional on receiving adequate international climate finance. The higher the NCQG, the faster planned transitions in recipient countries can be.

- Private blended finance deal announcements may continue to boom. As COP’s prominence and attendance have swelled in recent years, transactional outcomes and dealmaking on the sidelines of the formal negotiations have risen to rival (or perhaps surpass) negotiated outcomes in terms of climate impact. While negotiated outcomes will likely supersede transactional ones this year, the global attention placed on COP has become a useful forcing function for public-private partnerships, fundraising, and corporate action, if you can look past the inevitable bluster and hot air. As private capital participation surges in blended finance transactions for climate, this year’s COP may bring another wave of announcements.

These finance issues are wonky. But they are ultimately about energy inequality and climate justice. And they will play a major role in determining how policy and energy markets evolve. Let’s watch what happens in Baku.