China, the US, EU, and other major markets like India and Brazil take up the bulk of analysis in the IEA’s latest annual assessment of global energy investment flows. But this report (and the IEA’s awesome infographics) also tell us a lot about what’s happening in poorer countries — and what needs to change.

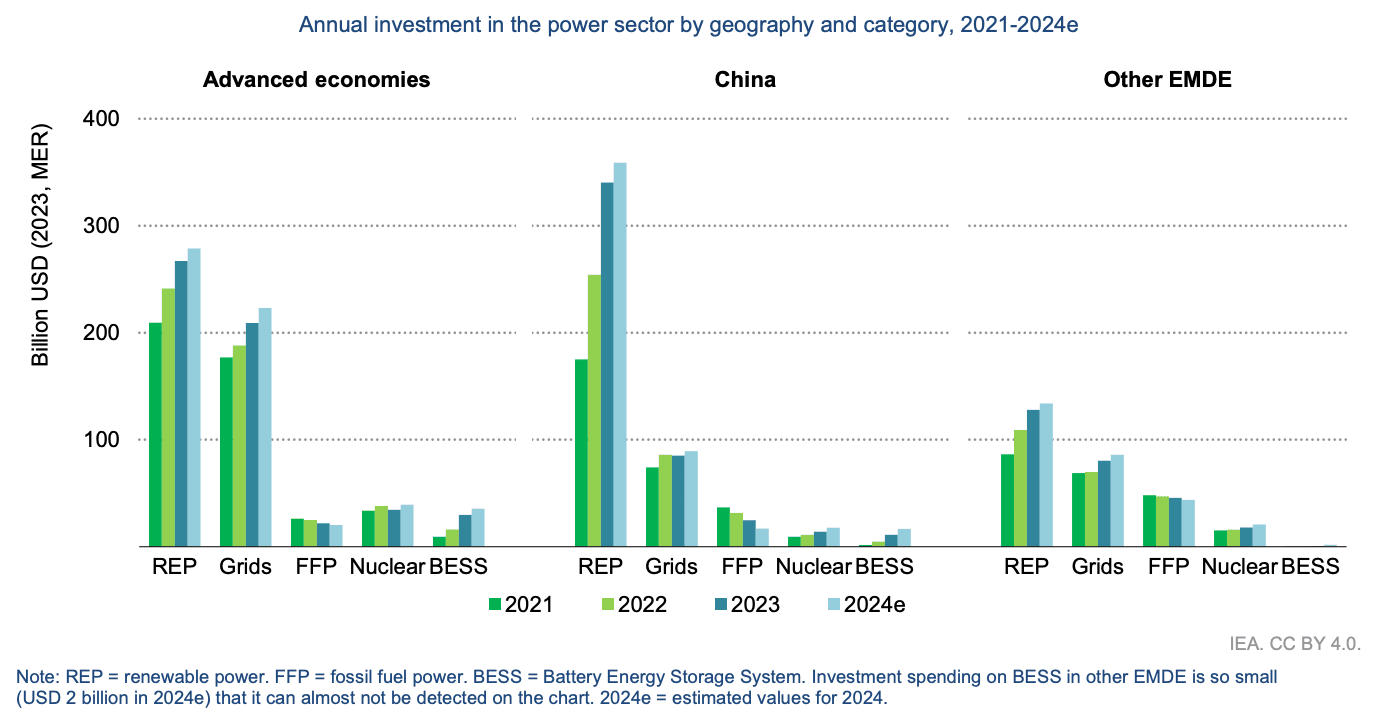

- First, the good news: Investment in renewable power rose across the board… Globally, investment in renewable power, grids, nuclear technology, and battery storage rose steadily between 2021 and 2024 — including in emerging and developing economies (EMDEs). There’s one outlier: investment in battery storage in EMDEs is so small it’s not visible on the chart.

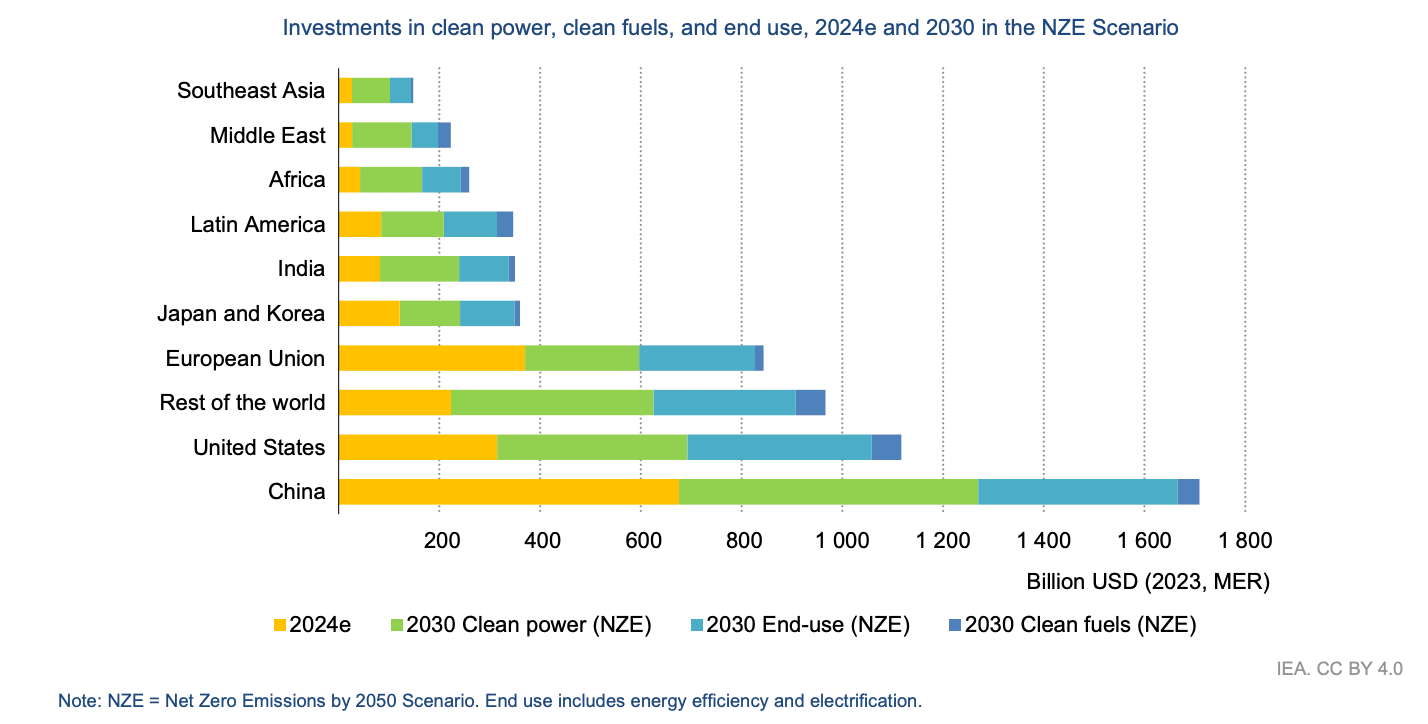

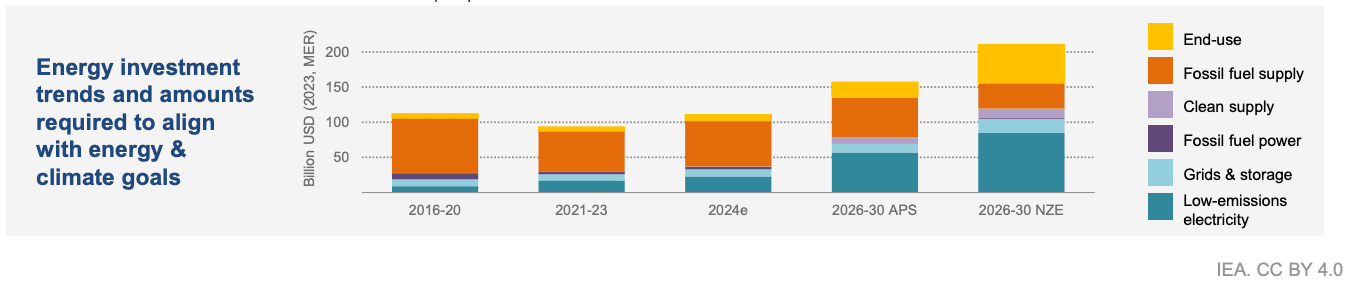

- …But developing countries still only capture a fraction of total investment. EMDEs outside China account for only 15% of global clean energy spending and only 20% of global investment in the power sector. At over $40 billion, IEA’s estimate for clean energy investment in Africa in 2024 is nearly double what the region saw in 2020 — but that’s starting from a very low bar. To meet COP28 goals, we’ll need to double clean energy investment by 2030 worldwide and quadruple it in EMDEs outside of China.

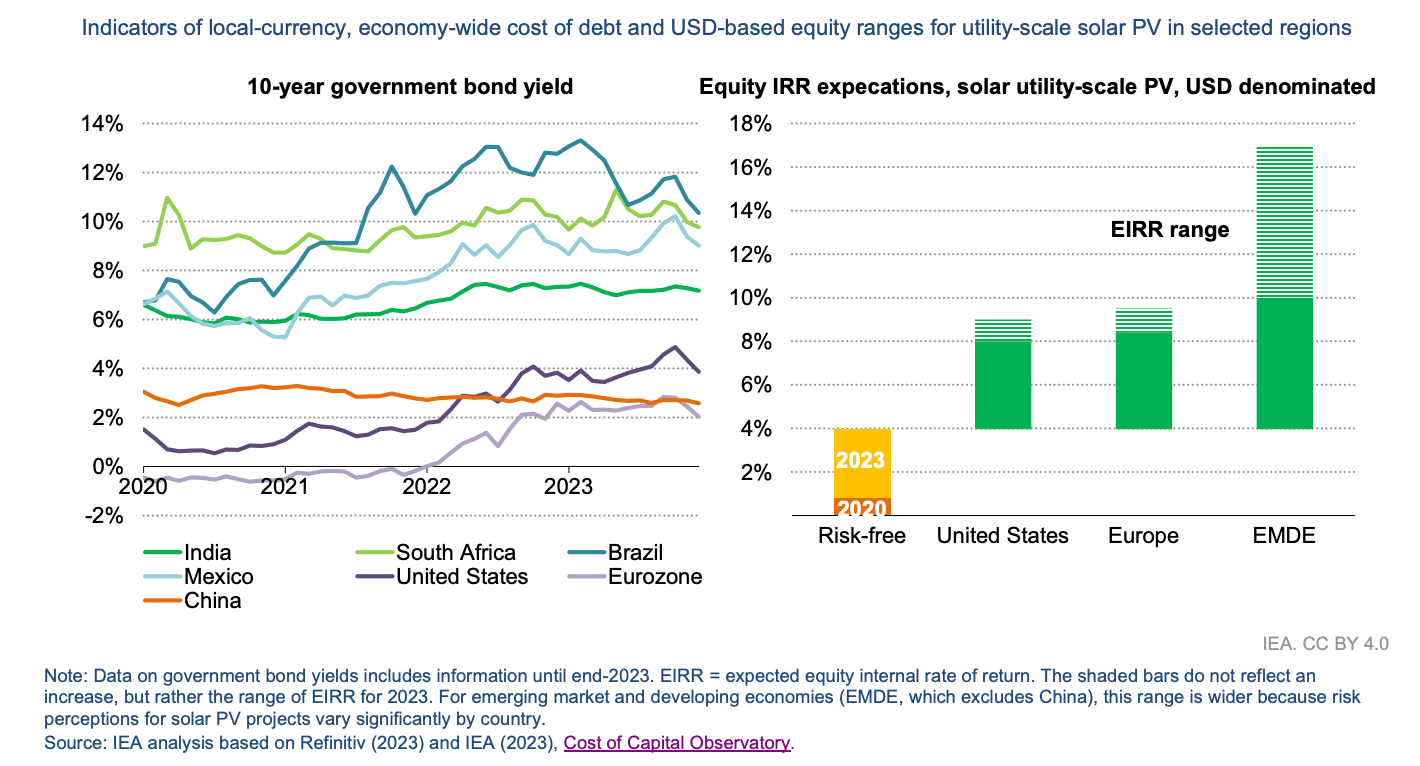

- The biggest barrier: Cost of capital. Financing costs in EMDEs are currently at least twice as high as in advanced economies or China — and even higher in Africa. This has especially damaging effects on clean energy technologies (which tend to be more capital-intensive, rely more on debt financing, and have smaller operating expenses than fossil fuels).

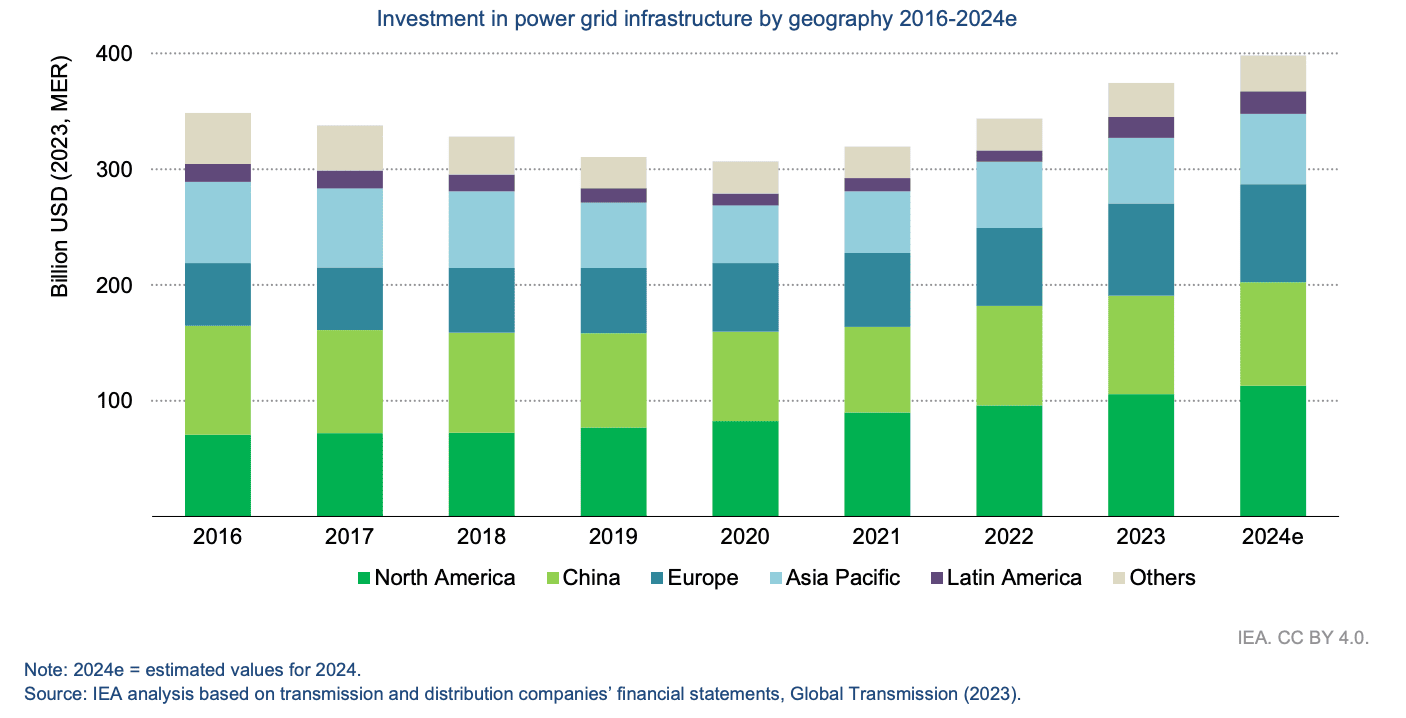

- Grid investment is growing (yay) — but it’s far too geographically concentrated. Spending on grids and storage (both crucial for renewable deployment) has ramped up — including in EMDEs outside China, where grid investment grew by 15%. But that growth was driven predominantly by Latin America, particularly Brazil. Investment in India, Africa, and Southeast Asia remained mostly unchanged. Overall, advanced economies and China account for 80% of total global grid investment — despite massive need elsewhere.

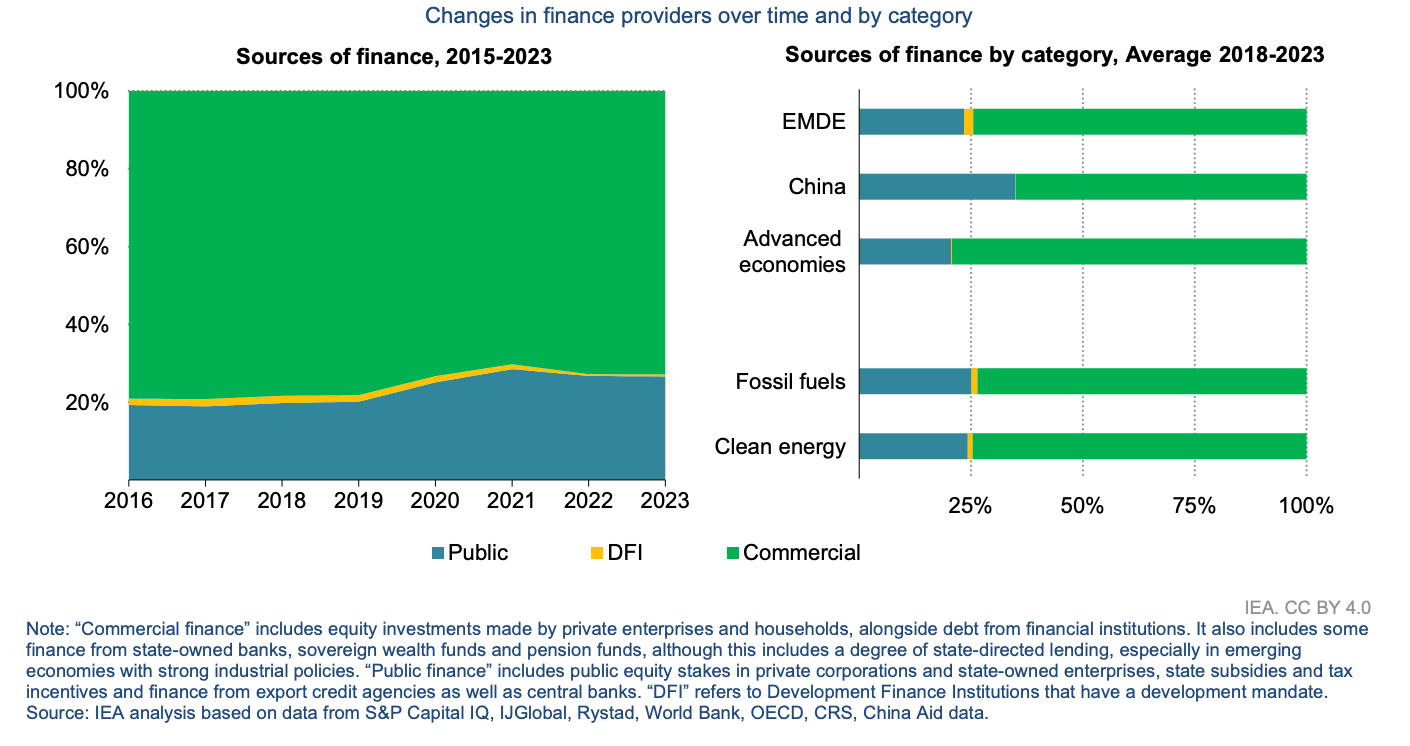

- All money is not the same: Private lending and equity investment both need to scale up. Globally, commercial finance dominates the energy sector. But outside of advanced economies, public finance plays a larger role, accounting for 32% of total spending between 2016-2023 in EDMEs outside China (compared to 14% in advanced economies). Upping the shares of private lending and equity investment will both be crucial. Private lending is increasingly important given the severe debt burden many of these countries face — and equity finance plays a key role in funding technologies with high upfront risks (e.g. geothermal, hydro); funding less mature technologies (e.g. battery storage, carbon capture); and supporting established tech in less mature markets. According to the IEA, this is especially important in Africa, where limited equity “acts as a brake on the development of bankable projects.”

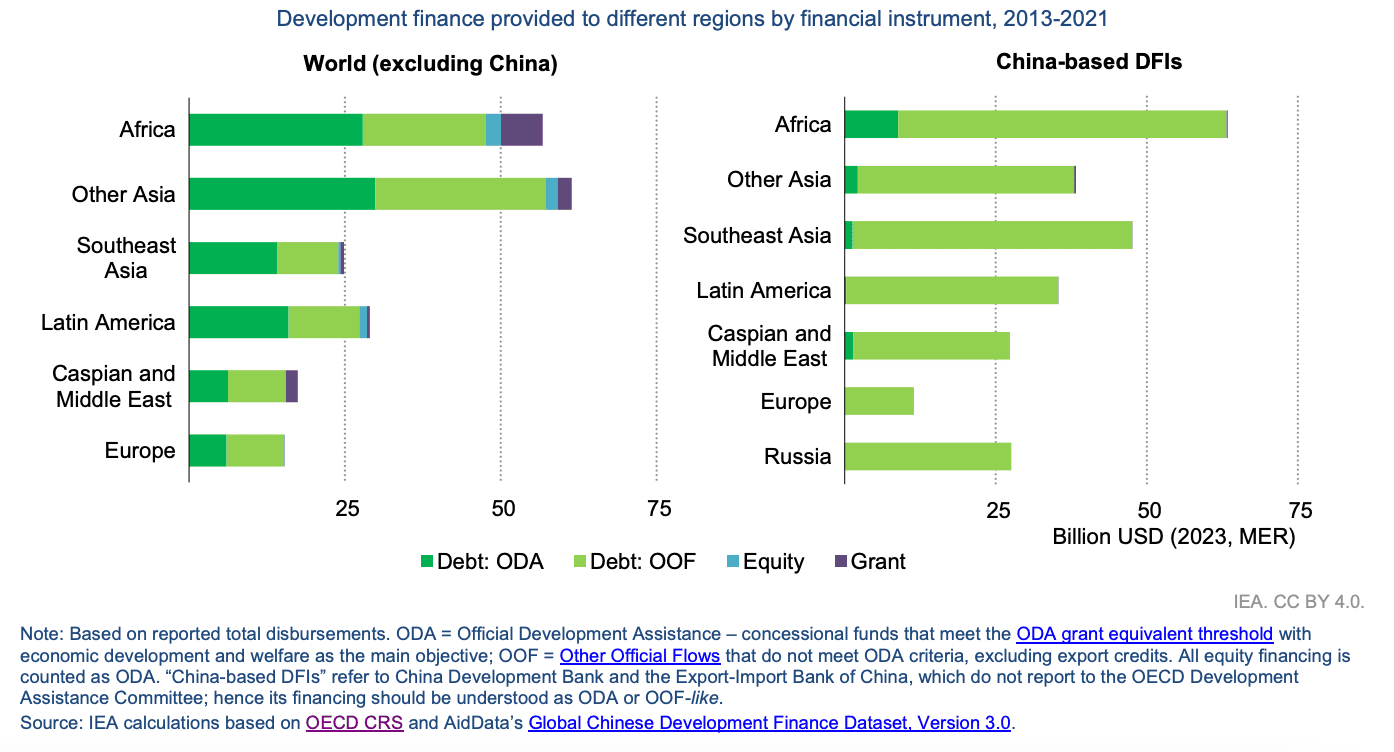

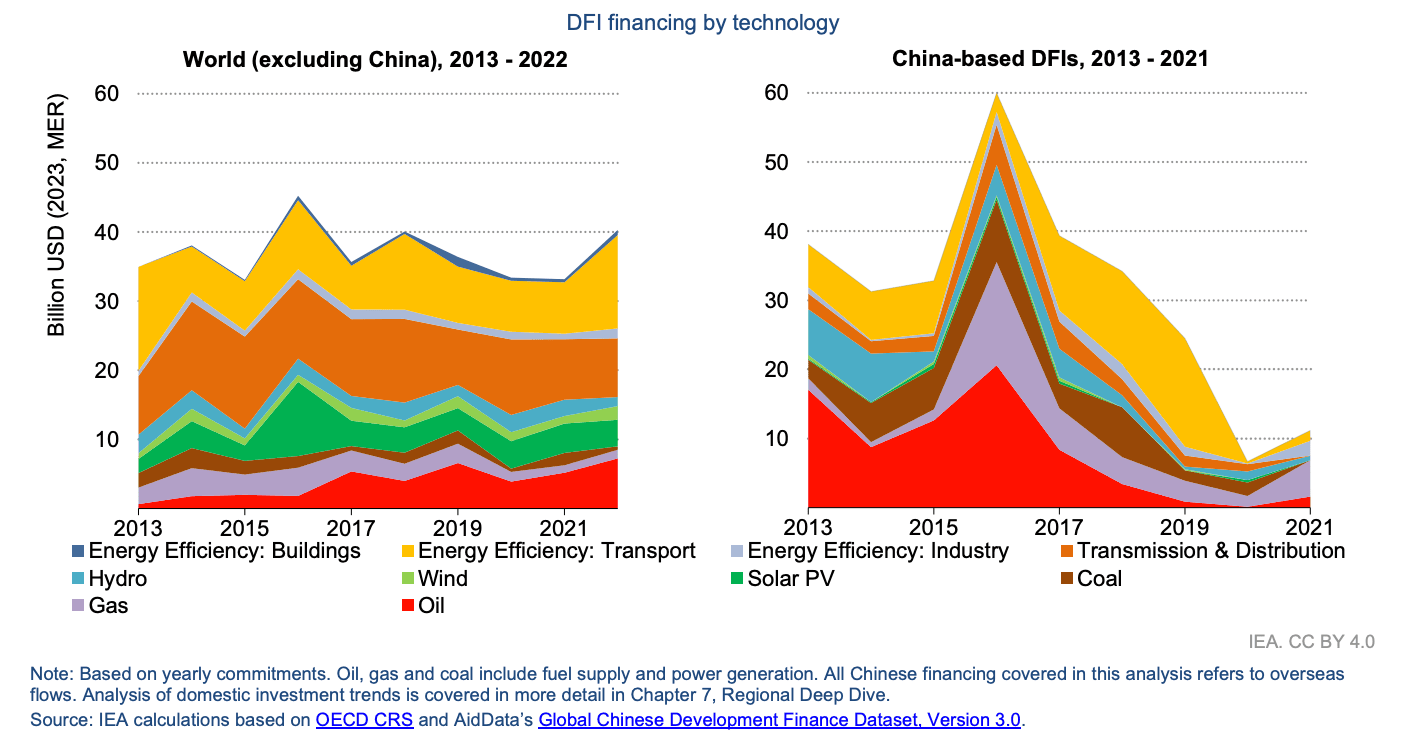

- DFIs deploy a more diverse array of financial instruments in Africa than anywhere else — but there’s more to do. DFIs can play a significant role in increasing equity investment and deploying much-needed grant capital, and could do more — but it hasn’t been easy. (In the US for example, tweaking an obscure accounting rule to enable the US Development Finance Corporation to make more equity investments enjoys broad bipartisan support, but has been a bone of contention since the agency was created in 2019.)

- In Africa, fossil fuels still dominate energy investment — but that’s almost entirely for upstream supply. The IEA estimates a total $110 billion will be invested in energy across Africa in 2024. The vast majority of that (nearly $70 billion) will go to upstream fossil fuel supply for export — not domestic power generation or infrastructure to serve local consumers.

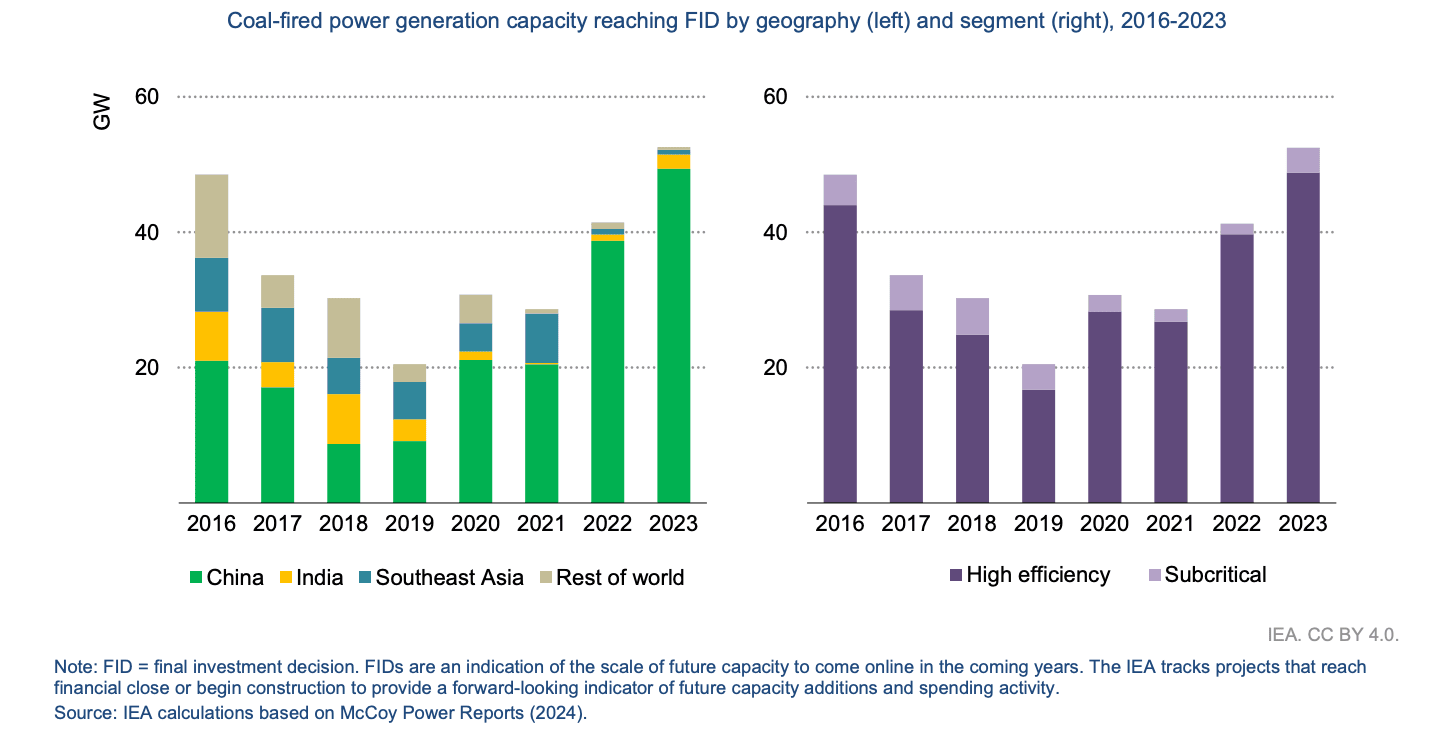

- But don’t worry: Coal is (still) not a thing in Africa. The amount of coal-fired power capacity reaching financial investment decision (FID) reached new heights in 2023 — but China accounted for 95% of the total. (On the lefthand chart, Africa is included in that tiny gray block on top — along with the “rest of world.”)

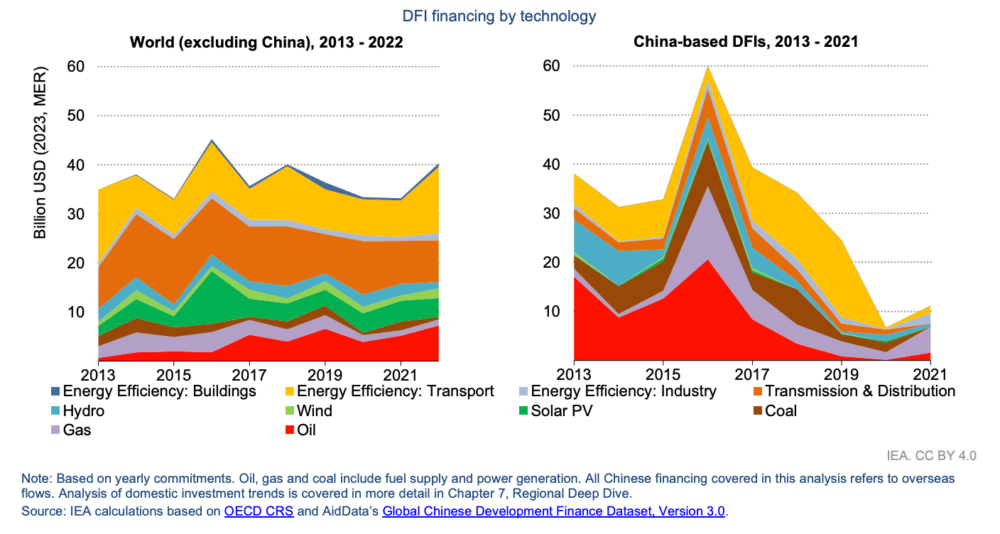

- Energy financing from China-based DFIs has dropped significantly — while other DFIs stayed steady. Energy finance from Chinese DFIs has fallen dramatically since its 2016 peak, while aggregate energy finance from other DFIs has remained fairly constant. But according to IEA, non-China DFI finance for energy-related sectors did reach a record high of $31 billion in disbursements in 2022, up by more than 50% from the previous year — pointing (perhaps, fingers crossed) to a longer-term trend.

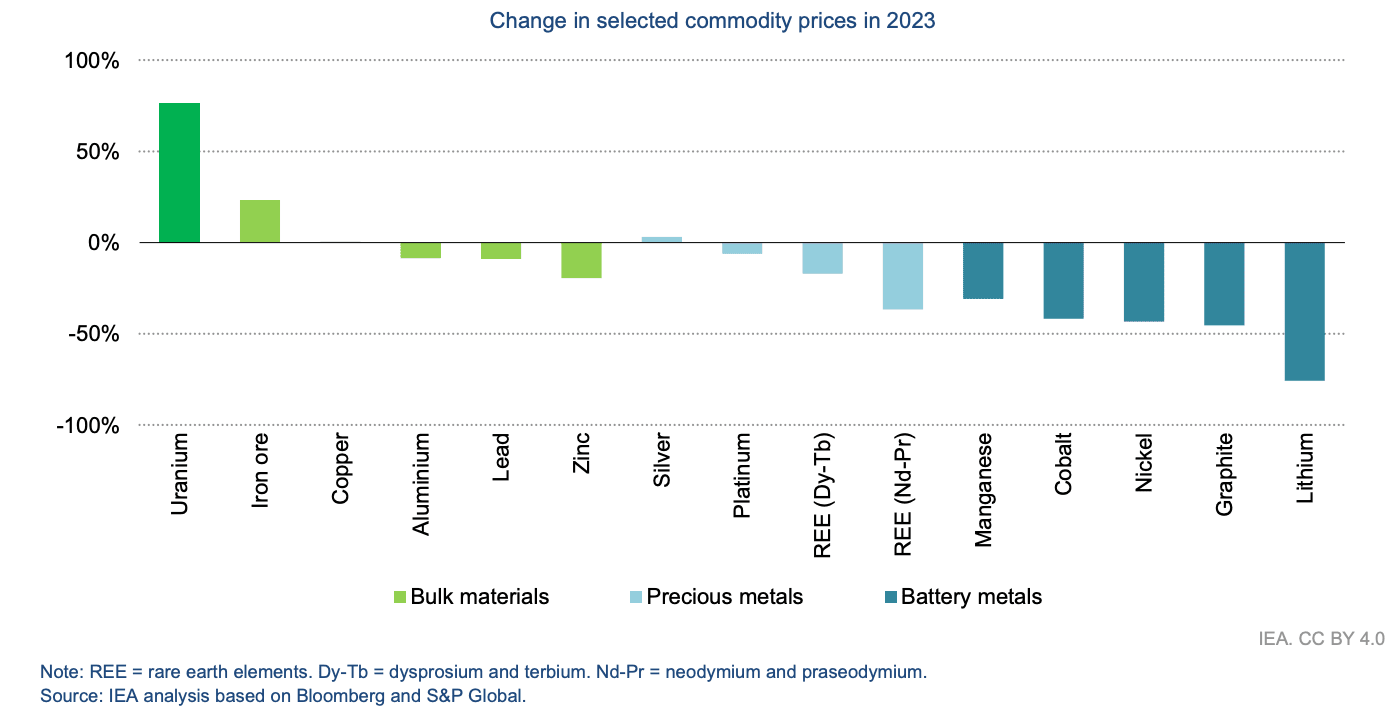

- Africa’s big growth area: clean energy minerals — even as prices drop. Globally, investment in exploration for critical minerals grew by 15% in 2023, with the largest growth in Canada, Australia, and Africa. This investment coincided with a significant decline in prices. Lithium, for example, experienced an 80% jump in exploration spending — and a 75% reduction in price. This is one area with huge volatility and many unknowns, posing big potential rewards (and risks) for low-income countries.