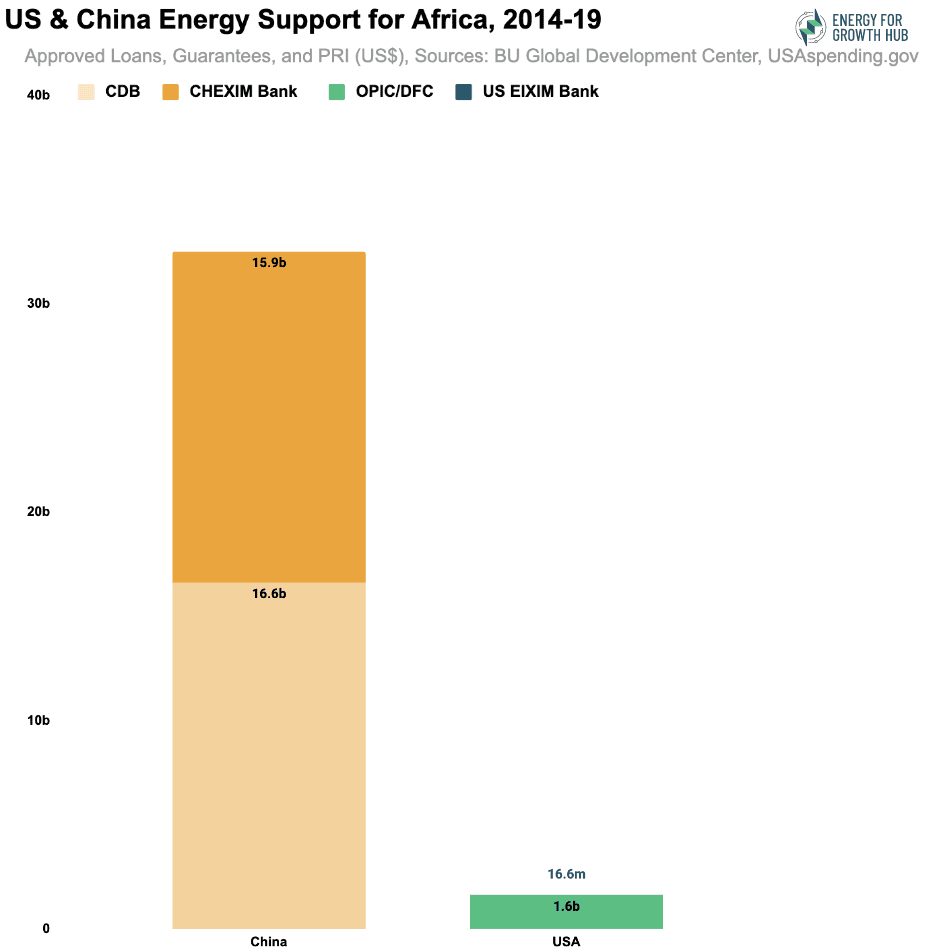

It’s a universal Washington truism: China is dominating global infrastructure investment, far eclipsing the United States. After the launch of Belt and Road in 2013, public Chinese investment flows into infrastructure surged across developing markets — including in energy. According to Boston University, between 2014-19, the China Development Bank and the Export-Import Bank of China approved $32.5 billion in support for African energy projects, compared to less than $2 billion by the peer US agencies over the same period.

The gap over those six years is striking. And the response in Washington has been nothing short of dramatic. Nearly every global investment initiative or debate — regardless of which party leads it — is framed around competition with China. The US even launched an entirely new agency, the US Development Finance Corporation (DFC), in part to counter China and scale up US infrastructure finance.

A screeching halt

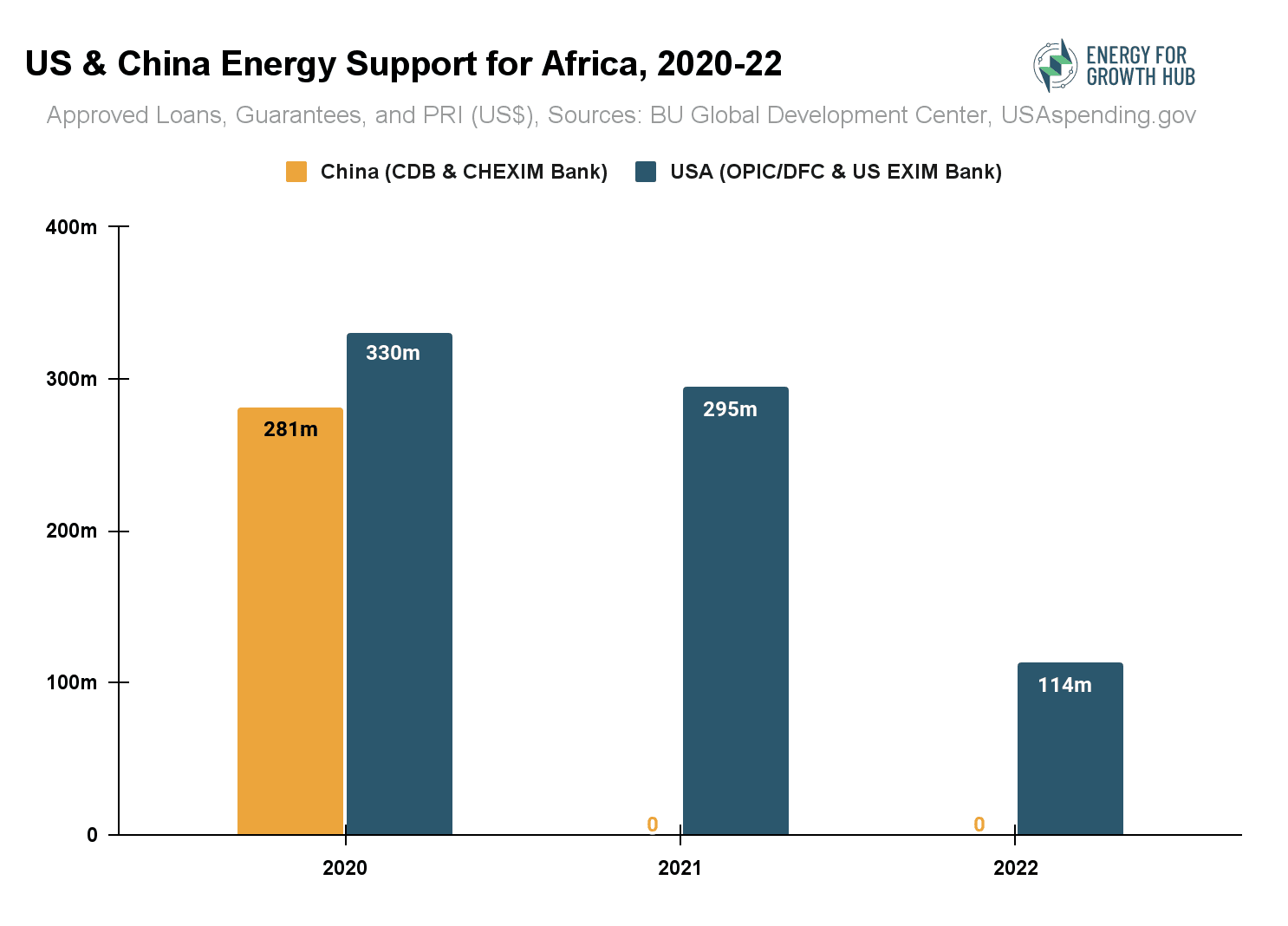

Yet here’s an interesting fact that few may have noticed: In 2021 and again in 2022, Chinese support for African energy from CDB and CHEXIM has been… zero. Meanwhile, US DFC and EXIM approvals stayed comparatively steady at $295 million in 2021 and $114 million in 2022.

How to interpret this wild swing?

- Temporary blip because of Covid? If true, then we should see an upswing in new support for 2023 (data expected this fall) and in future years.

- Permanent downshift as BRI hits a wall? Some have suggested that BRI overextended and is now due for a radical change. If this is right, then we will likely not see a recovery in flows.

- Refocus away from infrastructure? At the 2023 BRICS Summit, Chinese officials pledged to shift from infrastructure in Africa to local industrialization, while highlighting that they expect more of the future funding to come from the Chinese private sector. If so, Chinese public funding will expand in manufacturing and processing — but likely never again at the scale of peak BRI. (Although industrialization requires much more energy, so some forms of parallel energy investment would likely need to continue.)

- A mirage because of data anomalies? Chinese institutions are notoriously secretive, so the change could also reflect a lack of transparency about what’s really going on — or possibly an institutional shift as CDB and Chexim are eclipsed by other state-backed agencies.

Implications for the United States: Steady as she goes

The good news is that the US response should be the same no matter what explains the swings in Chinese investment. Concerns about Chinese dominance have been an important motivator for US action but, at heart, American support for African energy has been — and should remain — based on core foreign policy objectives. Whether Chinese investment resurges or disappears, the United States should:

- Increase the scale and effectiveness of its energy investment tools because that’s both urgent and in the US national interest;

- Update its thinking about the “why” of global infrastructure investment to reflect that it’s less a horse race with China over dollars or ribbon cutting, and more about helping allies build energy systems that successfully power economic growth and job creation.