The Problem

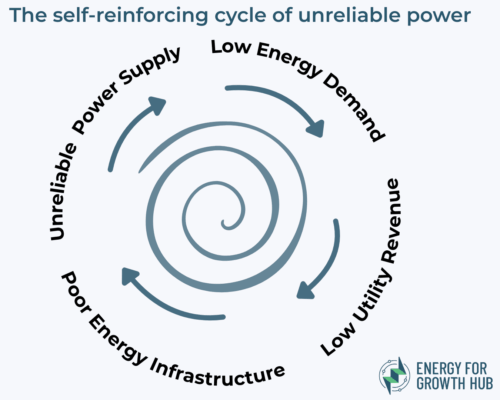

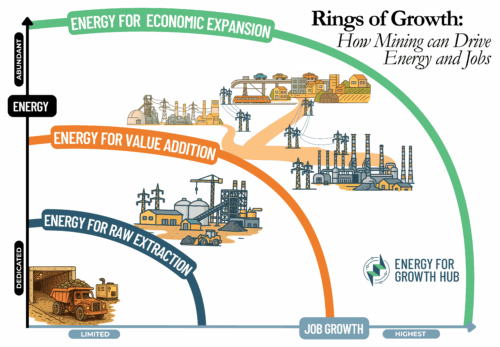

Energy demand in Asia and Africa is exploding – but these countries aren’t attracting enough capital to build the infrastructure they need.

Relevance

Meeting global energy goals in emerging economies requires massive public and private investments. Private developers, development finance institutions and multilaterals, philanthropy, and private equity all have roles to play.

Our Approach

We track investment trends, transactions, and the forces that shape capital flows to give policymakers clarity on what’s working (and not). We pay special attention to US government agencies, multilateral institutions like the World Bank and regional development banks, and the guidelines that emerge from global summits, such as the G20 or COP .

-

The US Development Finance Corporation

The DFC, the US government’s development finance institution launched in 2020, should be leading American investment in infrastructure abroad. See our work on DFC.

-

The World Bank

The Bank, owned by 189 member governments, is among the largest investors in infrastructure and increasingly plays a role in climate finance. See our work related to the World Bank.

-

Climate finance

Additional capital for climate-related projects could be a huge source for new energy investment in poor countries. At the 2009 COP, rich countries pledged to reach $100bn in climate finance per year, a figure that has yet to be met. See our relevant work here.